imarklab’s Role in the CEFRIO’s Research Project on Equity Crowdfunding

In 2014, the CEFRIO asked imarklab to conduct usability testing for a research project on equity crowdfunding. This research was a collaboration with the Autorité des marchés financiers (AMF) with the intent of establishing rules regarding this practice in Quebec. The main objective was to explore this phenomena around the world and evaluate investors’ risk perception for this kind of online investment.

We are proud of our contribution to this report published last may (report available in French only) and its role in protecting investors in Quebec. This case analysis briefly describes our research process.

Context

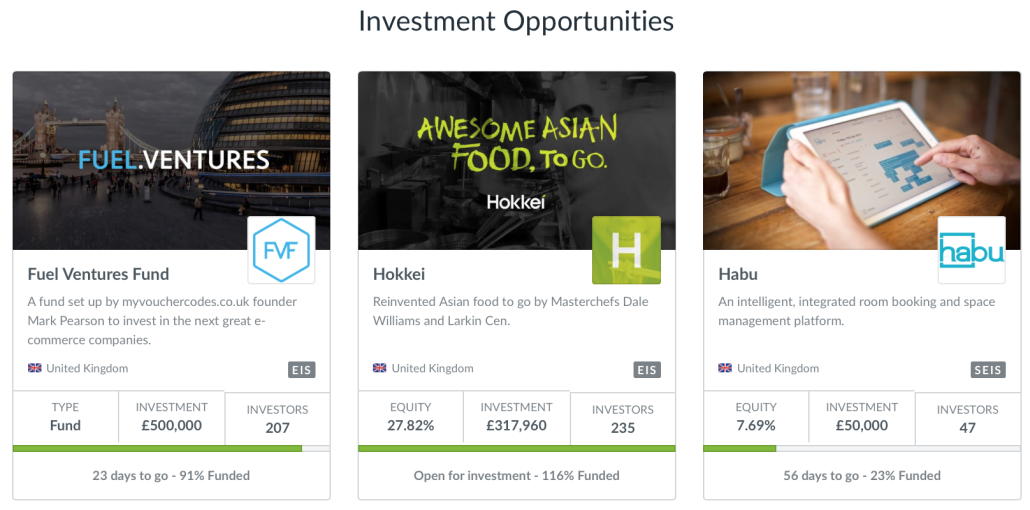

Equity crowdfunding is growing. New online marketplaces now allow Internet users to invest in startups companies for partial ownership, which can translate in a percentage of shares. The concept is simple: anyone can create a profile to “sell” something to potential investors. Early Shares, Crowdcube, Fundable and Seedrs are all examples of equity crowdfunding platforms. According to the CEFRIO’s report, there are already hundreds of these in the United States.

In contrast to platforms such as Kickstarter where people are asked to give money in order to contribute to projects, equity crowdfunding websites invite people to invest in businesses. There might be a return on investment but there is also a real risk of losing everything. Are investors really conscious of this risk when they are using these platforms? Are the risks presented clearly enough?

Objectives and Methods

The general goal of the study was to test equity crowdfunding online practices with potential investors. Thirty user tests were conducted in the Tech3Lab at HEC Montreal on a Web prototype mirroring Seedrs.com developed by w.illi.am. Eye tracking, emotions measurements and surveys were used in the usability testing process.

This project required detailed information impossible to collect with traditional usability testing. In addition to the users’ impressions, we needed to objectively assess if users saw and paid attention to specific elements of information during the investment process. We also needed to know if participants felt comfortable with the investment and its related risks. Were they scared when they read the risk warnings? Were their emotions positive or negative? Specifically, the objectives of conducting usability testing were to:

- Validate the online equity crowdfunding process with potential investors.

- Evaluate the consumers’ risk perception related to equity crowdfunding in general and to the online investment process.

- Make ergonomic recommendations to prevent fraud.

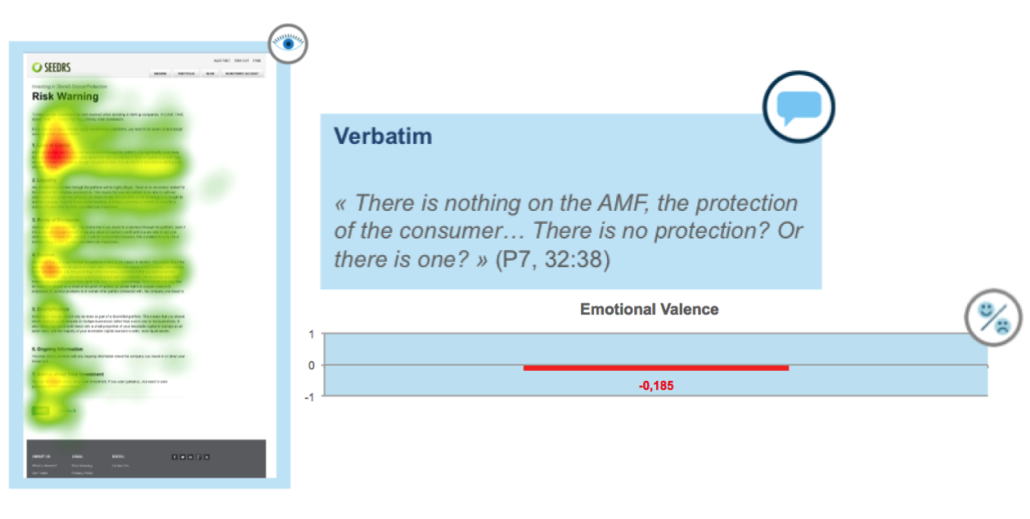

The different types of data collected were jointly analyzed after the tests to make final recommendations. Data triangulation allowed for a deeper understanding of users based on interviews, eye tracking data, facial emotions recognition and answers to quantitative questions. The figure below illustrates three kinds of data collected for the investment risk presentation page. The red zones indicate which areas participants most looked at, the verbatim underlines the absence of information about the AMF and the emotional valence scale reports negative emotions related to the experience on this page.

Results

Based on the research process, imarklab produced a series of recommendations aimed at equity crowdfunding platforms’ managers to protect potential investors. They focused on fraud prevention by allowing users to:

- Understand the real meaning of risks: To deepen the understanding of the risks presented during the investment process, two suggestions were made. First, we suggested adding links to official websites defining financial terms and indicating the presence of additional information through pop-up. Second, we recommended integrating downloads (PDF) for users who want to access more detailed information.

- Pay particular attention to risk warnings: We found that users would pay more attention to risks if they were presented with the consent questions before they decide how much to invest. We also suggested describing most critical risks first and requiring users to provide consent for each one.

- Be confortable with the online investment process: The implication of the AMF should be put forward during the whole process to make sure users are comfortable with it. Users also should have to confirm that they understand the legitimacy of an electronic signature before they invest. Finally, participants mentioned that reversibility options were important for them in order to easily go back to previous steps to change answers if they wish to.

For more details on this project, read the CEFRIO’s full report (in French).